In Houston, the typical closing costs are 2 – 5% of the sales price. This is independent of the 6% commissions that the real estate agents receive, as well as any concessions that the buyers are asking for. All of these should also be factored into your final numbers to have an idea of what you will pay.

What Is A Closing Cost?

Closing costs are fees – above the sale price – incurred at the home sale closing. They are paid when the property title transfers to the new buyer. Investopedia defines closing costs as “expenses over and above the price of the property in a real estate transaction.”

Closing costs are different depending on where you live. Bankrate provides a detailed list of Texas closing costs, broken out by lender fees, third-party fees, and taxes. In Houston, closing costs are typically 2 to 5% of the purchase price. Closing costs include:

What Are Closing Costs In Houston?

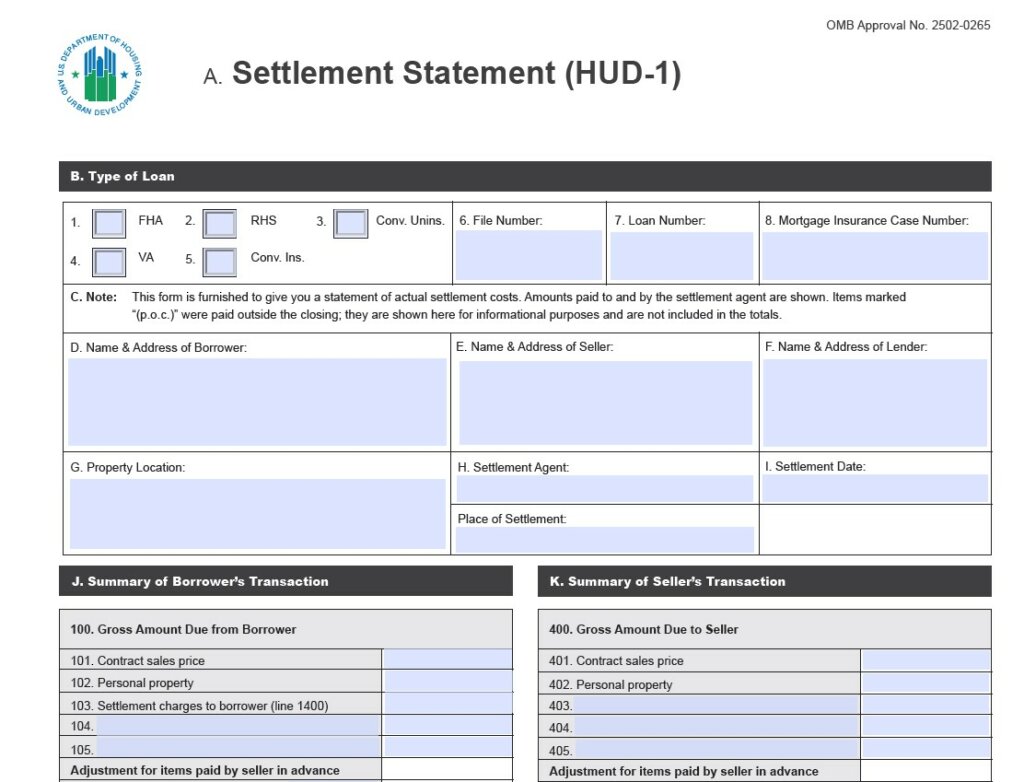

Below is a list of the primary closing cost items you should expect to pay if you are selling (seller closing costs):

Normal Closing Costs

- Title Insurance

- Escrow Fee

- Tax Certificate Fee

- Document Prep Fee

- Technology Fee

- Record Research Fee

- Property Taxes

- Recording Fees

- HOA Transfer Fee

- Notary Fee

- Real Estate Commissions (6%)

Payoffs

- Liens

- Mortgage Balance

Other Potential Costs

- Home-owners insurance policy

- Seller concessions

- Survey cost

All of these costs will be found the in HUD-1 statement that is used in Texas.

Who Pays Closing Costs?

As the seller, you will be paying the closing costs that were listed above. A traditional buyer will have their own set of costs that are mostly related to the mortgage they are getting for the house. They may even ask you to pay some of their costs to help them be able to afford the house.

Want To Sell Your House And Avoid Paying Closing Costs?

By working with a home buyer like Brilliant Day Homes, you can avoid the closing costs.